Our Founder Mr. Maheshwari comes from a middle class family background. He understood the value of money management early in life. He successfully implemented the principal of financial planning and wealth management in his personal life.

Mr. Maheshwari is a “Chartered Accountant”(CA) and “Company Secretary” (CS). He is a meritorious professional with over 2 decades of rich experience with core competence in financial engineering with innovative ideas & solutions, business fund-raising and corporate management consultancy.

According to him, human life can be divided into two facets (i) Work (ii) Family. In the first facet of life called “WORK”, a person may be (a) Employed (b) Self-employed (c) Businessman or (d) an Investor. He may be in one or multiple “working activities” as per his competence and opportunities. Second Facet of life called “FAMILY” , he will have only one family life. The money earned through “WORK” should be useful and available for FAMILY to meet its present and future needs and aspirations.

Mr. Maheshwari further adds that a person gets education and trains himself to work so that he can earn money. Naturally, he will be an expert in his field of “WORK”. However, every person will not be formally educated for money management. Therefore, money earned by the person will not be always available to his family when it is needed the most.

Mr. Maheshwari, in his professional career of 2 decades provided management consultancy to various business group and managed “MONEY” for their businesses. So he has given his professional services in first facet of human life i.e. “WORK”. Now, he decided to start a new venture “MIDAS TOUCH” to assist and advise the financial aspect of second facet of human life i.e. “FAMILY”.

In the present time, for a common person to understand complex financial products for investment is challenging . He normally invests based on ‘financial product specific advisor’ such as insurance, mutual fund and SIP advisors. He may also invest based on advice of his ‘so called expert friends’. This method of financial planning process is highly risky. Therefore, Mr. Maheshwari thought of starting “MIDAS TOUCH” to give “One Stop Shop” for Financial planning and wealth management.

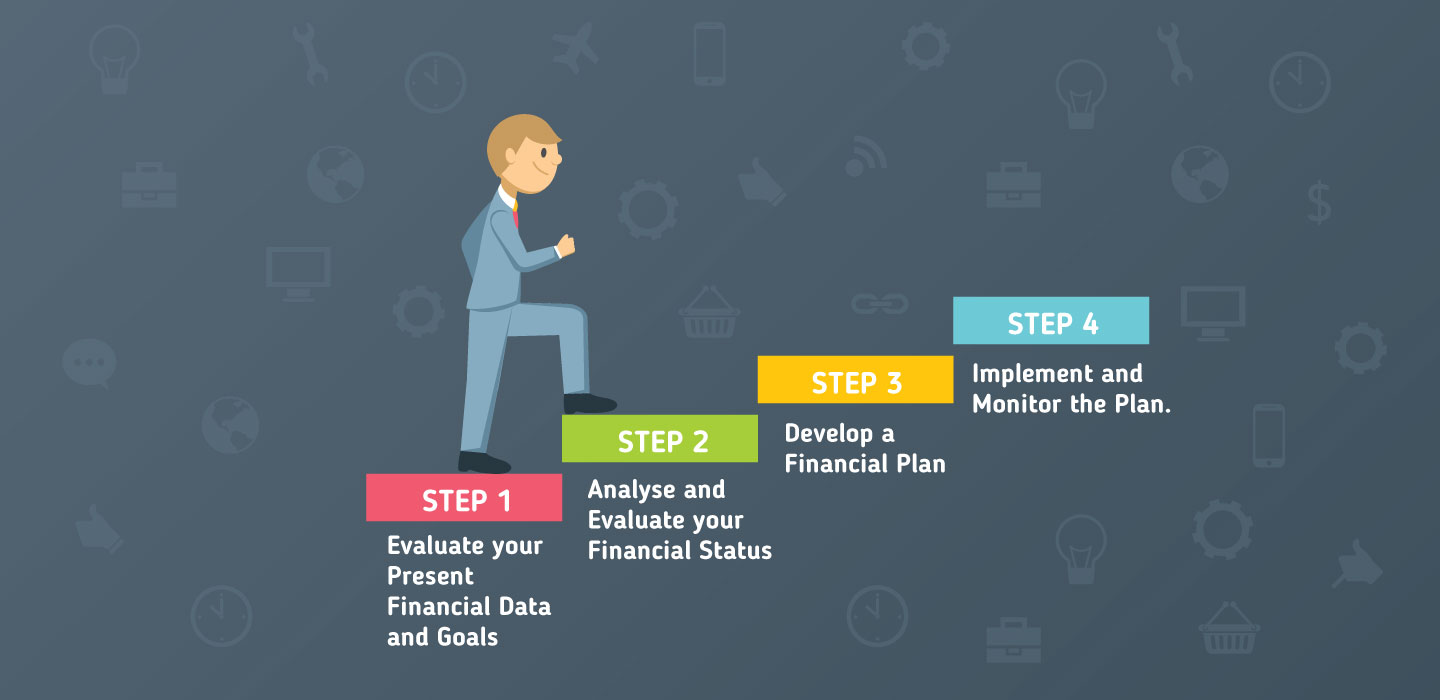

At MIDAS TOUCH, we will assist and advice you for financial planning through various financial products and provide you options for wealth creation for yourself and for your next generation. We (i) evaluate your present financial data and goals, (ii) Analyse and evaluate your financial status (iii) Develop a financial plan (iv) implement and monitor the plan.